Forty-one states and Washington, DC, collect income taxes every year—and nine states collect no income tax at all. States with an income tax require employers to withhold state income tax on wages earned within the state. Some states have other withholding mechanisms, particularly with respect to partnerships. Most states require taxpayers to make quarterly estimated tax payments not expected to be satisfied by withholding tax.

Combined Corporate Rates Would Exceed 30 Percent in Most States Under Harris’s Tax Plan

- Other states with a flat-rate income tax are Arizona (2.5%), Colorado (4.4%), Idaho (5.8%), Illinois (4.95%), Kentucky (4.5%), Michigan (4.25%), Mississippi (5%), North Carolina (4.75%), Pennsylvania (3.07%), and Utah (4.85%).

- Residents may find their tax burden somewhat alleviated by the diverse range of opportunities available in the nation’s capital.

- Nevada has a state and local tax rate close to the national average, providing residents with a moderate tax burden.

- West Virginia’s state and local tax rate slightly exceeds the national average, resulting in a moderate tax burden for residents.

- Although New Jersey taxes most retirement benefits, retirees 62 and older may deduct a significant portion of their taxable income.

Similarly, in Texas, residents enjoy the absence of income tax but struggle with one of the nation’s highest real estate tax rates, accounting for 1.63% of their income. In New Hampshire, the tax rate applies to dividends and interest income and regular income is typically not subject to state tax. Similarly, in Washington, only capital gains income is subject to the state’s income tax. Other states with a flat-rate income tax are Arizona (2.5%), Colorado (4.4%), Idaho (5.8%), Illinois (4.95%), Kentucky (4.5%), Michigan (4.25%), Mississippi (5%), North Carolina (4.75%), Pennsylvania (3.07%), and Utah (4.85%). States collected state income taxes from residents annually.

Interactive map: Highest and lowest tax rates in 2024

West Virginia’s state and local tax rate slightly exceeds the national average, resulting in a moderate tax burden for residents. However, the state’s lower cost of living may help alleviate some of these tax obligations for individuals and families residing here. North Carolina maintains a state and local tax rate slightly above the national average, resulting in a moderate tax burden for residents. However, the state’s relatively lower cost of living may help mitigate some of these tax obligations for individuals and families living here. South Dakota maintains a state and local tax rate slightly above the national average, resulting in a moderate tax burden for residents.

state tax rates

So, if you’re looking to save on income taxes in retirement, the state with the highest income tax rate may not be right for you. New York has the third highest income tax rate in the U.S. at 10.9% for incomes over $25 million. For instance, New average state income tax York City charges an additional income tax of up to 3.876%.

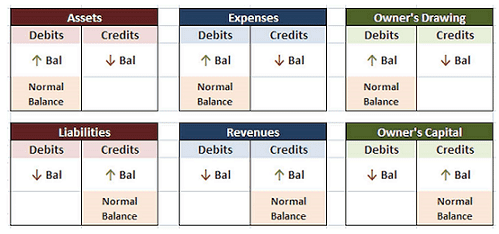

New York ranked second with a total effective tax rate of 14.74% and the average household spending approximately $13,774 in state and local taxes annually. The WalletHub study also provides the average annual amount of state and local taxes paid by residents based on their respective state’s median income, giving a better indication of how normal balance much these residents pay each year. Choose any state from the list above for detailed state income tax information including 2025 income tax tables, state tax deductions, and state-specific income tax calculators. Many state pages also provide direct links to selected income tax return forms and other resources. Several states try to keep things simple by applying the same tax rate to most income.

- One simple way to rank state tax burdens is by the percentage of all state residents’ total income that goes to state and local taxes.

- This data can be downloaded as an Excel file, courtesy of The Tax Foundation .

- However, the state’s proximity to major metropolitan areas and robust economy may provide residents with opportunities that help mitigate some of these tax responsibilities.

- However, the absence of state income tax may help lessen some of these tax obligations for individuals and families residing there.

A Comparison of State Tax Rates

Colorado residents experience a state and local tax rate slightly Bookkeeping for Painters higher than the national average, resulting in a moderate tax burden. Despite this, Colorado offers a desirable balance of services and tax obligations for its residents. Below, you’ll find the top 10 states with the highest income tax rates.